Buying used cars is commonplace and often more affordable than getting a brand new vehicle. Many dealers have reliable vehicles that can be a steal but being adamant about finding the perfect fit is the key. Check out how to buy a used car in Texas right here.

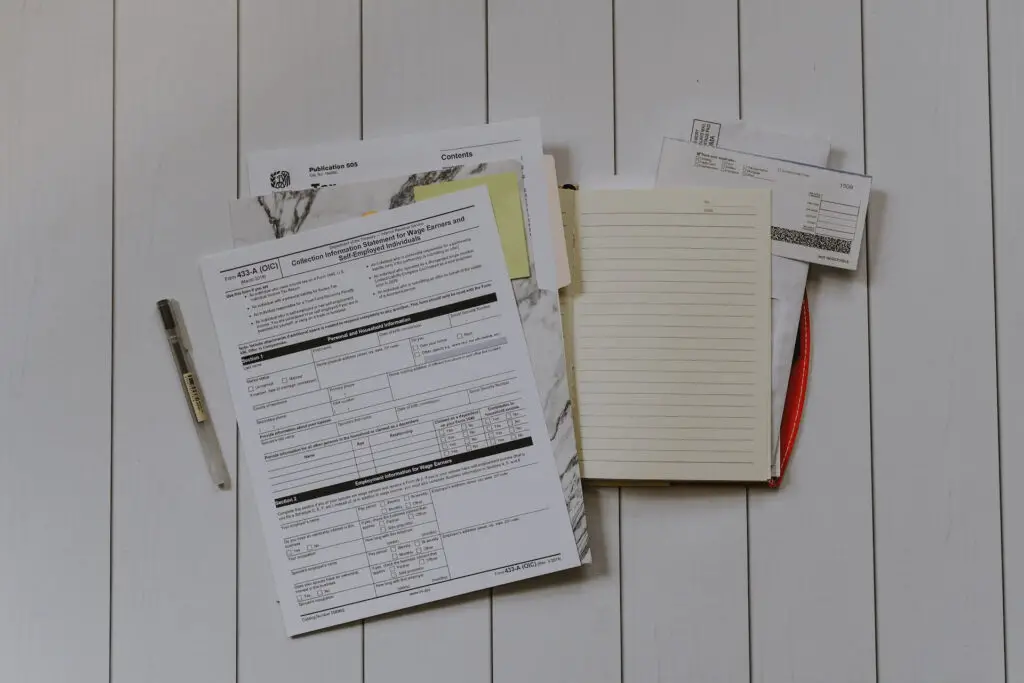

Buying a used car in Texas can be easy if you have a set budget, know how to negotiate a suitable price, and understand the legal requirements and sales tax. The two essentials you need for buying a used car are a valid driver’s license and an insurance card. Some dealerships may ask you to submit other documents as proof of income, too.

If you’re planning to purchase a used car in TX, check out this short guide to learn all about it.

Table of Contents

How to Buy a Used Car In Texas – Three Key Things to Look Into

Whether you need a family four-wheeler or a small city vehicle, you’ll be able to find both versions at most dealerships across TX. However, if you intend to buy from a private seller, there are a few things you should consider and pay attention to since you don’t want your hard-earned money to go to waste.

In short, the factors to consider when buying a used vehicle are:

- Its history and condition,

- How fast you can get a vehicle title,

- The sales tax if you buy from a private seller.

Additionally, if you go to a dealership to purchase a used car, these are the following required (and potentially required) documents:

- Valid driver’s license,

- Insurance card,

- Possible trade documents (like title and loan agreements)

- The most recent pay stubs (typically the last two pays)

- Proof of residency (such as utility bills)

- Character references (from someone outside of your household).

Checking Out the Car’s History Is Essential

Some dealerships or even private sellers may ask you to provide a character reference, which is fair if the dealership has a strong reputation or such terms of use. However, you can do the same. A dealership or a private seller has to allow you to verify information about the car you’re interested in, so you know what you’re getting yourself into.

That means checking out the car’s history, from title checks to mileage, prior damage and repairs, and alike. The title deed may not do much for you, but learning about the types of damages and repairs the car went through can help you see what its weaknesses are and if it’s affordable in the long run.

If Possible, Get a Mechanic to Check Out the Car

The best-case scenario would be to ask a mechanic to do a thorough car checkup. Dealerships sometimes arrange this for free as a sign of goodwill. If you establish a good relationship and communication line with a private seller, they may not get quickly (or at all) offended by your due diligence.

This is recommended to do only when you’re serious about purchasing. Otherwise, you’ll be wasting everyone’s time on thorough checkups of a vehicle you’re not that interested in. So, before resorting to the mechanic, be sure you want this car.

Apply for a Vehicle Title and Pay the Sales Tax

When you purchase a car from a private seller, there are a few legal things to take care of, primarily the title and the sales tax. If you buy a vehicle from a dealership, the title will be taken care of for you, but it’s a different story with private sales.

Here’s when you’ll need a paper called Form 130-U. This is a special Texas title application and registration form where you enter various information about yourself, the previous title owner, and the vehicle.

This, along with your driver’s license or other legal identification, proof of liability insurance, and a signed vehicle title, is necessary to take and submit at your local tax office. Preferably, it should be done together with the person selling you the car (the previous title owner).

Ensure You Understand the Legal Fees and Requirements

There’s something called an SPV, which is short for Standard Presumptive Value. You pay a vehicle sales tax at the local tax office while taking the needed registration paperwork there.

The vehicle sales tax is around 6,25% of the vehicle purchase price in Texas. At the same time, SPV can be different depending on the vehicle’s condition, the numbers on the odometer, and potential damages. You can calculate your SPV here.

Determine a Budget and Negotiate the Price to Fit It

The most important factor when purchasing a used vehicle is the budget. See what the bottom and top limits are for you and try not to break them. If you do go over the upper limit, you may as well be buying a brand-new car. Try your best to be within budget but be prepared to negotiate, too.

For example, knowing everything about the vehicle can help you negotiate a better deal. If the mileage on the odometer doesn’t justify the price – negotiate. If the external condition of the car doesn’t look right – negotiate. You get the deal.

When You’re Prepared, Buying a Used Car In Texas Is Very Simple

Buying used cars requires some research, no matter which state you’re in. Still, TX is known for wide and long streets, roads of pretty great quality, and a good infrastructure. This is why it’s one of the best states to buy used cars in.

The most crucial part of buying a used car is calculating the sales tax if you buy from a private seller and registering your name as the new title owner. With these tips, you’ll indeed find the best deal out there.